The UK mortgage market is poised for a high-activity year. With over 1.6 million fixed-rate mortgage deals expiring in 2025, advisers are preparing for a sharp uptick in remortgage conversations, rate reviews, and customer re-engagement.

At the same time, a series of parallel forces are creating both pressure and opportunity for mortgage intermediaries:

Rising Consumer Expectations

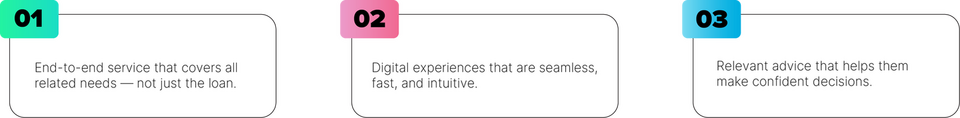

Today’s clients expect more than just a mortgage. They’re looking for:

Intermediaries are in a prime position to deliver - not just the mortgage, but the essential protections that support it.

Insurance as an Advised Moment

Home insurance is a mandatory part of the mortgage journey, yet it’s often treated as an afterthought - outsourced, delayed, or left to aggregators. But with the right strategy, it can be:

A way to retain control of the customer journey

An opportunity to enhance trust and advice perception

A channel to add meaningful, recurring revenue

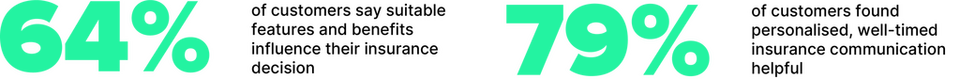

The data backs it up:

Regulatory Pressure: Delivering Fair Value

The FCA’s Consumer Duty is raising the bar on product oversight and customer outcomes. Fair value isn’t just a pricing issue - it’s about:

Making advice processes easy to understand and act on

Ensuring clients aren't paying for features they don’t need

Clear communication of cover

For intermediaries, actioning a fair value strategy is essential to build trust. This also gives the adviser themselves confidence that their recommendations are not just competitive - they’re the right thing for the client.

Your Role Is Expanding — and That’s a Good Thing

As product complexity grows and client expectations shift, advisers have a unique opportunity to own more of the journey - from first conversation to mortgage protection.

The winners in 2025 won’t just be fast at finding the right rate - they’ll be the ones who: