Pricing in the insurance industry has traditionally been a balancing act between risk, profitability, and competitiveness. But in a digital-first environment - where advisers need to convert clients quickly and fairly - the old one-size-fits-all approach is no longer enough.

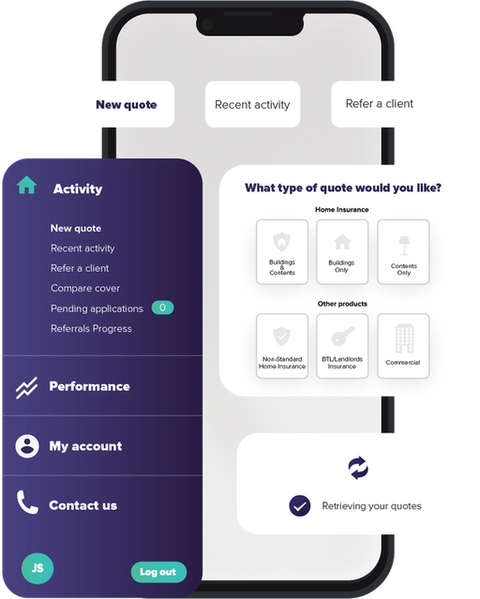

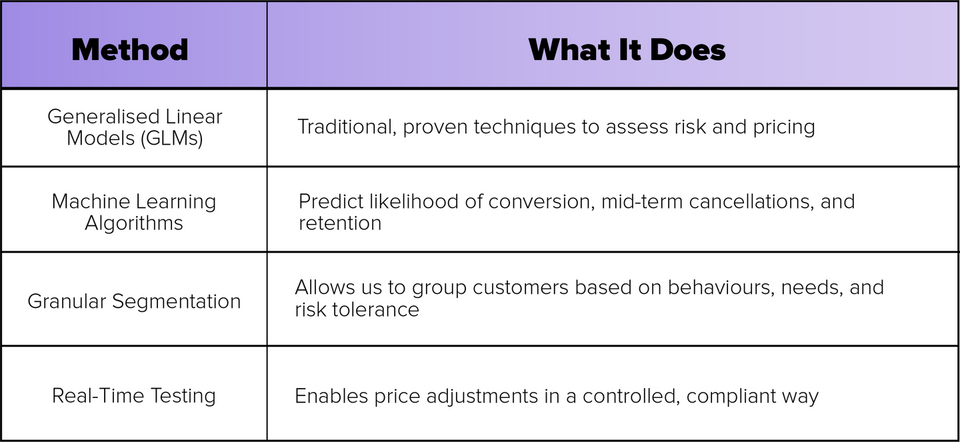

That’s why Uinsure has developed a sophisticated pricing optimisation model that helps advisers offer more personalised, effective quotes - without compromising compliance, margin, or client trust.

What Is Price Optimisation in Insurance?

At its core, price optimisation is about using data to:

The result? Smarter pricing that improves both conversion and customer satisfaction.

Why This Matters to Intermediaries

Many mortgage advisers don’t want to be pricing experts - and they shouldn’t have to be. But having the right pricing in the background gives them confidence to:

Recommend quotes that are competitive and credible

Handle objections more effectively (“Why is this more expensive than online?”)

Conversion optimisation, especially for price-sensitive or comparison-prone clients

With nearly half of price-driven non-buyers saying they’d convert with a £50/year reduction, even modest adjustments can have big impacts.

Fair, Not Discounted

Smart pricing isn’t about racing to the bottom - it’s about precision.

By using advanced models, advisers can offer:

And perhaps most importantly: advice that clients feel confident accepting, because the price feels right - and fair.

A Win-Win Outcome

When done right, pricing sophistication delivers:

Higher conversion for advisers

Greater transparency and satisfaction for clients

Long-term trust and retention for everyone

Price will always matter. But with Uinsure’s optimiser, you can win on value, timing, and fairness - not just the number at the bottom of the quote.