“Fair value” isn’t just a regulatory checkbox - it’s now a central expectation of how products are priced, delivered, and experienced.

For mortgage intermediaries, this means reassessing not just the mortgage advice process, but also the insurance and protection products offered alongside it. Under the FCA’s Consumer Duty, the focus is now on whether customers are getting clear, appropriate, and demonstrable value - from start to finish.

What the FCA Expects

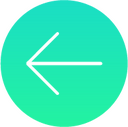

The Consumer Duty framework demands that all financial products deliver:

The FCA wants evidence that products are not only compliant, but genuinely useful, understandable, and fairly priced.

Fair Value in Practice: A Home Insurance Example

Let’s say a policy includes bicycle cover as an optional add-on. Seems reasonable, right?

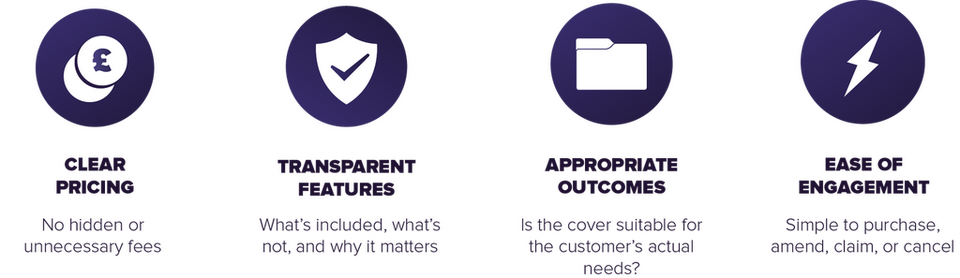

But what if:

That’s not fair value - it’s misaligned pricing and a potential compliance risk. Fair value means clients only pay for what they need, and understand what they’re getting in return.

How Intermediaries Can Ensure Fair Value

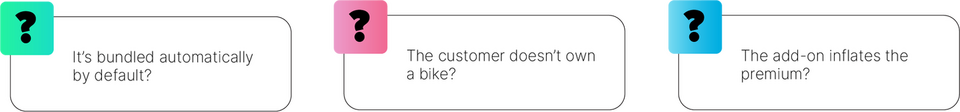

You don’t need to become a compliance officer - but you do need a process that supports the outcomes the FCA wants to see.

Here’s what that can look like in your business:

What Uinsure Is Doing

Uinsure has embedded fair value oversight into its core operating model. That includes:

A monthly Product & Pricing Committee review

Internal audits and MI tracking to spot gaps in performance

Ongoing improvements to communication, accessibility, and adviser tools

All of this ensures advisers are recommending products that meet the Duty’s requirements - and deliver real, measurable value to clients.

It’s Not Just About Compliance — It’s About Confidence

Fair value builds trust - not just with regulators, but with customers. When clients understand what they’re buying, and believe it’s worth the cost:

And advisers can feel confident that their recommendations are not just competitive - they’re the right thing for the client.