For mortgage advisers, this rise of aggregators has created real challenges - especially when it comes to retaining control of the customer relationship.

Why Advisers Can Do Better

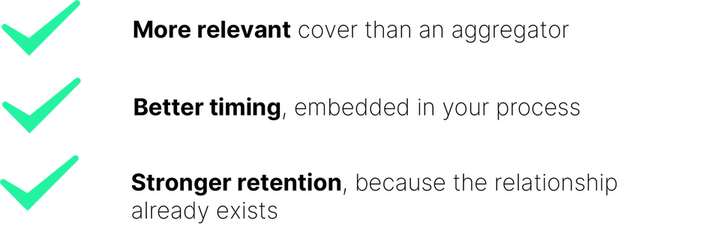

As an intermediary, you already hold the two most powerful cards:

Client trust

Timely insight

You know when your client needs insurance, you understand their property, and you have a regulatory duty to ensure they’re covered appropriately.

With the right tools, you can provide:

The Cost of Leakage

Every time a client leaves your advice journey to “shop around”:

Uinsure’s data shows that a significant percentage of policies are lost simply because the process wasn’t embedded - the client had to go elsewhere.

With embedded panel-based insurance, advisers can keep control, boost conversion, and avoid unnecessary leakage.

Reframing Insurance as a Value Conversation

Rather than competing with aggregators on price alone, advisers should position insurance as:

A necessary protection, not an optional extra

A core part of homeownership, not a standalone product

A natural next step in the mortgage journey

Clients are far more open to these messages when delivered in the context of a mortgage conversation - especially if the process is fast, relevant, and pain-free.

From Competitor to Complement

Rather than asking clients to compare or shop around, advisers can say:

That’s how intermediaries compete - not by trying to out-advertise aggregators, but by offering something fundamentally better.