Welcome to the first ever edition of The Edge!

2025 is shaping up to be one of the busiest years for mortgage intermediaries in a decade. Over 1.6 million fixed-rate deals are set to expire this year and in Q1 we saw a busy market driven by the rush to speed through transactions ahead of the end of the temporary stamp duty relief. As we look ahead to what will hopefully be a busy summer, there is a definite opportunity to improve client outcomes through great advice - and it’s not just about mortgages.

Advisers are under growing pressure - and presented with real potential - to offer a more complete customer experience. Insurance, once treated as a secondary add-on, is fast becoming a key differentiator. It’s where you can deepen relationships, stand out and add real value.

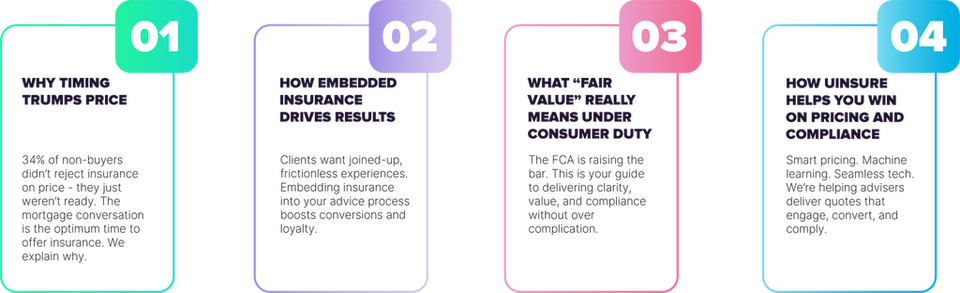

This white paper explores why now is the moment to rethink your insurance approach - and how timing, tech, and regulation are reshaping distribution as we know it.

What's Inside...

Who Should Read This?

- Mortgage brokers and advisers

- Financial intermediaries

- Advisory firm principals

- Anyone ready to grow insurance income and client value

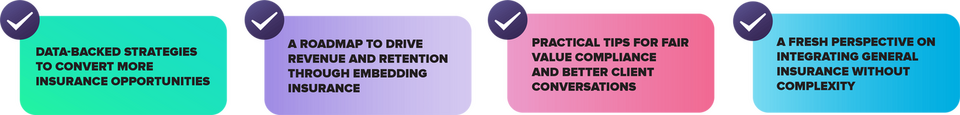

What You’ll Take Away: