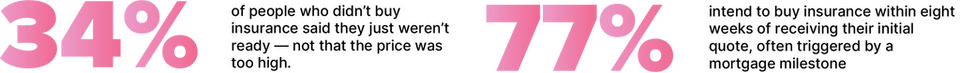

For years, conventional wisdom has said that price is the most important factor in an insurance purchase. And yes, price matters - but it’s only part of the story.

Uinsure’s research, based on insights from over 2,000 buyers and non-buyers of insurance, reveals a more nuanced truth:

Timing is just as critical - and often more so - than price.

The Data Says It All

From our latest customer insight research:

In other words, many customers weren’t saying “no” - they were saying “not yet.”

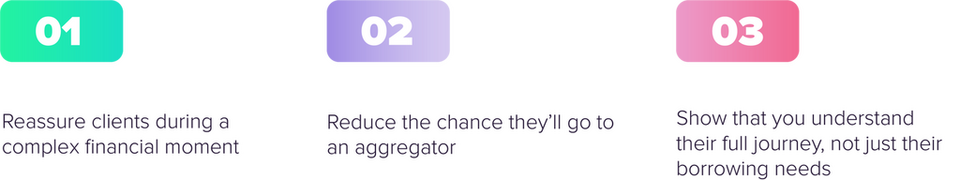

Advisers Have a Timing Advantage

The timing challenge is one that mortgage intermediaries are uniquely positioned to solve. Unlike aggregators or direct insurers, advisers already know:

When a client is buying or remortgaging

When documents are issued

When exchange or completion is likely to happen

These life-stage markers are the perfect opportunity to reintroduce insurance - especially when you know the client needs cover to proceed.

Engaging at these moments doesn’t just increase conversion - it increases relevance and trust.

Industry Backing: Timing Beats Tactics

Major consultancies echo this data-driven approach:

Deloitte reports that price sensitivity drops sharply when customers perceive an immediate need - especially around big financial life events. Other studies have also shown how event based communications can significantly increase conversion.

This aligns perfectly with mortgage milestones - offering a natural, timely moment to reintroduce protection as a priority, not a product push.

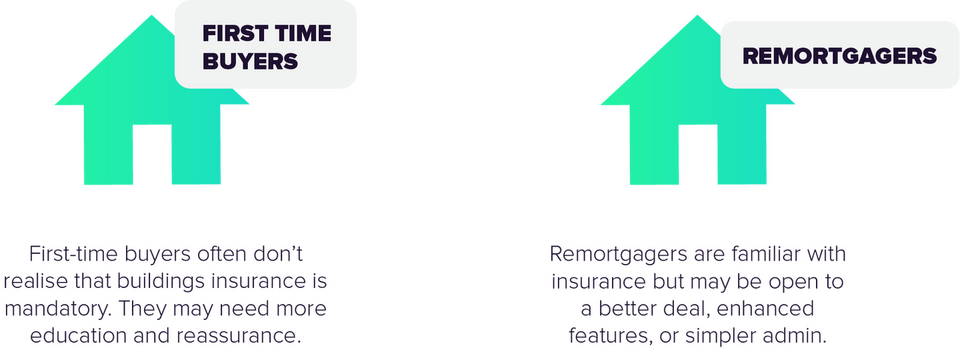

Smart Segmentation Improves Outcomes

Timing isn’t just about dates - it’s about who you’re speaking to and what they need.

Uinsure’s segmentation data shows that advisers who tailor their communication and timing by buyer type see significantly improved conversion and satisfaction.

Timing as a Trust Builder

Well-timed insurance conversations don’t just sell policies - they: